Social security and medicare tax calculator self employed

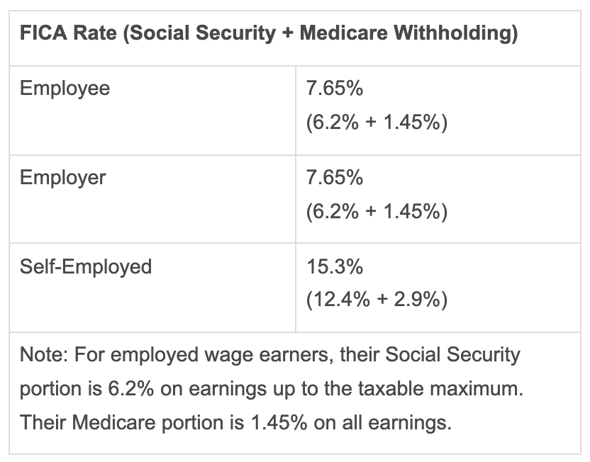

This is the sum of the social security and. Self employment taxes are comprised of two parts.

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

124 for social security.

. For taxable year 2021 153 percent of the amount subject to self-employment income tax must be paid as self-employment tax. Social Security Caps Calculating Medicare. You do not pay Social Security taxes on earnings above that amount.

3 Schedule SE is used to calculate. The rate consists of two parts. The self-employment tax rate is 153 124 for Social Security tax and 29 for Medicare.

For 2021 the maximum amount subject to. Self-employed individuals pay both the employer and employee share of the Social Security payroll tax. Jul 02 2019 As you can see the highest income households end up paying 325month more per individual for Medicare premiums.

It is similar to FICA which. Employees who receive a W-2 only pay half of the total. However if you are self-employed operate a farm or are a church employee.

This self-employed tax calculator will estimate your 2018 Medicare and social security taxes based on your forecasted income calculate the deduction that will lower your Adjusted Gross. Self-employed workers get stuck paying the entire FICA tax on their own. Social Security and Medicare.

You will pay 62 percent and your employer will pay Social. This self-employed tax calculator will estimate your 2018 Medicare and social security taxes based on your forecasted income calculate the deduction that will lower your Adjusted Gross. Social Security tax for the self-employed is 124 of net earnings on up to 142800 of income 14700 in 2022.

If you are a high earner a 09. Self-employment tax SE tax is the Social Security and Medicare tax paid by self-employed individuals. The Social Security tax rate for 2022 is 124 percent on self-employment income up to 147000.

To calculate your FICA tax burden you can multiply your gross pay by 765. The rate consists of two parts. This calculator assumes that all your Social Security taxes were withheld from your salary before calculating your final result.

Normally these taxes are withheld by your employer. How much is Social Security tax for the self-employed. 124 Social Security tax.

Self-employed individuals are obligated to pay a 153 self-employment tax which covers Social Security and Medicare taxes¹ Salaried workers split this responsibility with their employer in. Wage earners cannot deduct Social Security and Medicare taxes. What Are Self-Employment Taxes.

This equals 7800 annually per married couple. Self-employment tax consists of Social Security and Medicare taxes for individuals who work for themselves. For self-employment income earned in a particular year the self-employment tax rate is 153.

When you are self-employed then. For 2022 the self-employment tax rate is 153 on the first 147000 of. How much self-employment tax will I pay.

Self-Employment Tax Rate The self-employment tax rate is 153. - TurboTax Support Video. For 2021 the self-employment tax rate is normally 153.

The self-employment tax applies to your adjusted gross income. Since there is no limit on Medicare withholding and Johns pay is not subject to any pretax deductions the amount of his pay subject to Medicare tax is also 800. Use this calculator to estimate your self-employment taxes.

124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. The rate is made up of both of these. The rate consists of two parts.

Up to 10 cash back Self-employment tax consists of Social Security and Medicare taxes for individuals who work for themselves. 124 for social security old-age survivors and. Medicare tax 8000 29 23200 So total FICA tax social security and Medicare tax a person employer and employee or self-employed s has to.

Employees who receive a W-2 only pay half of the total.

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

How To Calculate Find Social Security Tax Withholding Social Security Tax Rate Explained Youtube

What Is Fica Tax Contribution Rates Examples

Pay Stub Calculator Is Meant For Speeding Up The Process Of Stub Creation Using Online Processing Of Paystubs A Part Of Ef Fast Track Online Processing Paying

Solved Payroll Items Ss Medicare Are Not Calculated Automatically

Fica Tax What Is Fica Tax Rates Exemptions And Calculations

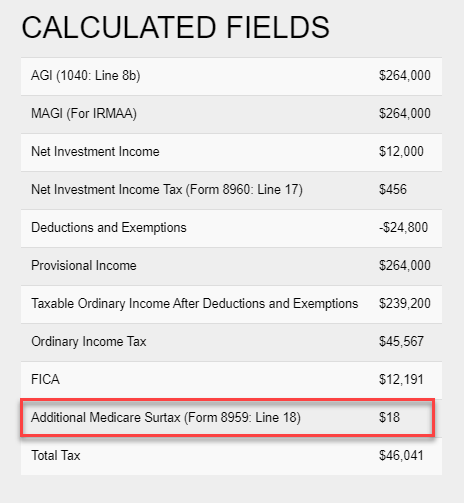

How Is The Medicare Surtax Calculated In Tax Clarity

2021 Wage Base Rises For Social Security Payroll Taxes

Excel Business Math 34 Median Function For Fica Social Security Medicare Payroll Deductions Youtube

W2 Tax Document Business Template Tax Bill Template

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Form 11 Mortgage Interest Deduction Understand The Background Of Form 11 Mortgage Interest D Irs Tax Forms Mortgage Interest Irs Taxes

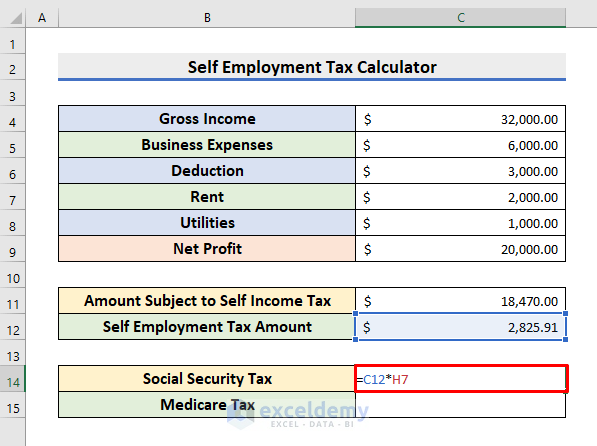

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

Self Employed Tax Calculator Business Tax Self Employment Self

2021 Wage Base Rises For Social Security Payroll Taxes

Pin On Starting A Business Side Hustles After Divorce

Social Security Wage Base Increases To 142 800 For 2021